The biotech bear market that started in February 2021 created some dramatically underpriced stocks. There is free money lying on the sidewalk, just waiting for you to pick it up.

Dear Biotechies:

The must-follow Biotech Investor (@learnbiotech) wrote a thought-provoking post on “p-hacking.” P-hacking in clinical drug trials refers to the misuse of data analysis or selective reporting aimed at manufacturing or strengthening statistically significant results. Outside investors can be fooled by this, but not the FDA. So the purpose generally is to get more funding, either in hopes another trial will have more positive data, or simply to continue paying executive salaries as long as possible before the house of cards collapses.

Biotech Investor posted a list of p-hacking strategies to be aware of and said he has come across numbers 3, 6, and 8 through 11 too often.

h/t @learnbiotech

Some of these are more serious than others in the sense that they can raise the p-value more. Biotech Investor also posted a graphic showing the potential effect of some of these p-hacking strategies.

h/t @learnbiotech

As you can see, favorable imputation, optional topping, and selective reporting are the big ones. As Biotech Investor said: “Hard to know without raw data but be prepared to ask & investigate where possible!”

Let's delve deeper into the principal methods by which investigators may p-hack, indicators that external stakeholders can use to spot manipulated data, and a notable empirical example drawn from the pharmaceutical sector.

P-hacking occurs when researchers exploit analytical flexibility—altering outcomes, stopping rules, or statistical models—to achieve p-values below the conventional 0.05 threshold, regardless of the underlying signal in the data. In the context of drug development, this practice can distort estimates of efficacy or safety, leading to regulatory and reputational risk.

Common Methods of P-hacking

Outcome switching - Changing the primary endpoint mid-trial or in analysis to one yielding significance.

Optional stopping (“peeking”) - Periodically inspecting results during data collection and halting enrollment once p ><0.05 is reached.

Multiple comparisons without correction - Testing numerous subgroups, doses, time points or covariate adjustments and reporting only significant findings.

Data dredging - Mining large datasets for any significant association—often through trial-and-error model specifications—then presenting the best outcome as confirmatory.

Selective reporting - Omitting non-significant endpoints or adverse events from publications or registries, while highlighting favorable effects.

Flexible imputation and handling of missing data - Choosing between multiple imputation methods or censoring rules after seeing which yields significance.

Some Red Flags for Detecting P-hacked Data

“Bunching” of p-values just below 0.05 - An anomalously high density of results in the narrow band immediately under the significance cutoff often signals selective reporting or repeated testing until success. See https://statisticsbyjim.com/hypothesis-testing/p-hacking/

Discontinuity at the α = 0.05 threshold - Formal density-discontinuity tests can reveal upward jumps at the 5% boundary, particularly prominent in smaller sponsor–driven Phase 3 trials. See https://arxiv.org/pdf/1907.00185

Discrepancies between protocol and publication - Mismatches in pre-specified versus published endpoints or statistical methods, as documented in trial registries, suggest post-hoc outcome selection. See https://trn.tulane.edu/wp-content/uploads/sites/72/2020/09/P-hacking-and-pretrial-registration.pdf

Sponsor-specific patterns - Smaller biotechs may exhibit a higher fraction of just-barely-significant results in late-phase trials, consistent with both selective continuation and p-hacking incentives.

Implausibly narrow confidence intervals or effect sizes - Overly precise estimates, despite modest sample sizes or high dropout rates, can indicate model overfitting or data trimming.

A Notable Empirical Example

Adda, Ottaviani, and Decker (2020) analyzed p-values of primary outcomes from ClinicalTrials.gov for Phases 2 and 3 of drug development. They found no overall bunching just above 0.05, but a pronounced density jump at 5% significance in Phase 3 trials sponsored by smaller companies. After accounting for selective trial continuation, unexplained excess significance persisted among small sponsors. That is strong evidence of p-hacking or selective reporting under economic pressure.

P-hacking undermines the integrity of clinical evidence and can expose sponsors to very adverse regulatory scrutiny. To mitigate this risk, investors should look for:

1. Rigorous pre-registration of endpoints and analysis plans (e.g., SPIRIT/ICH-E9-compliant)

2. Transparent publication of all pre-specified outcomes, regardless of statistical significance

3. Independent audits of p-value distributions and trial registry concordance

By systematically monitoring for statistical anomalies and enforcing protocol fidelity, regulators and investors can better safeguard drug development against the distortions of p-hacking.

* * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * *

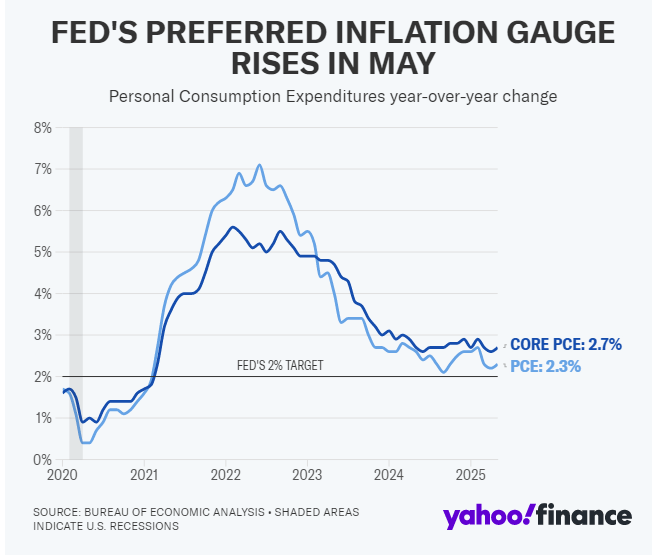

This morning's May Personal Consumption Expenditures (PCE) index increased 2.3% year-over-year, a slight uptick from April's 2.2%. The month-over-month increase from April was 0.1%. The Fed's favorite inflation indicator, the core PCE that excludes changes in food and energy prices, was up 2.7% year-over-year. Both the April increase and the consensus expectation for May were 2.6%. Month-over-month, the core PCE rose 0.2%, also a tenth above both the April increase and the consensus expectation for May.

h/t Yahoo Finance

Fed Chairman Powell just testified that the central bank is “well-positioned to wait” before moving interest rates, and I don't think there's anything in this report to change that. Wall Street focused on other data showing signs of slowing economic growth. Real personal spending decreased 0.3% in May after increasing 0.1% in April. Personal income fell 0.4% in May, well below the 0.7% increase seen in April and the 0.3% increase economists had expected. But Powell needs to see a direct impact on the labor markets before he makes a move.

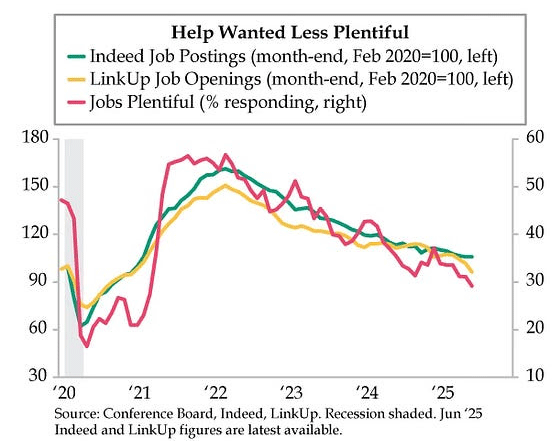

Last September 16, CareerBuilder and Monster merged. The CEO said: “The combination of CareerBuilder and Monster brings together two strong, trusted, complementary brands to create a job board with greater scale and reach.”

On Tuesday, a short nine months later, the merged company filed for Chapter 11 bankruptcy. What happened? This:

h/t @DiMartinoBooth

The latest Conference Board Consumer Confidence report said that households’ “appraisal of current job availability weakened for the sixth consecutive month,” and consumers “were more pessimistic about business conditions and job availability over the next six months.”

Weak help wanted ads could be an early warning indicator, but as I've said, I am watching what the Fed watches - weekly new unemployment claims - to see if there is real employment weakness. If and when that number goes over 250,000 for a few weeks in a row, the pressure on the Fed to cut rates even though inflation is above their 2% goal will be intense. Today it was 236,000, a decrease of 10,000 from last week's 246,000. So, we're flirting with 250,000, but not there.

Continuing claims did go up from 1.937 million last week to 1.974 million, the highest level since November 2021. An increase in continuing claims is a sign that those out of work are taking longer to find new jobs, but that's not the main focus of the Fed.

Even so, according to the CME FedWatch Tool, after the employment claims data, markets are now pricing in a 27% chance the Fed cuts interest rates at its July 30 meeting, up from a 12.5% chance last week, Odds of a cut by the end of September surged from 64% to 92%.

I still think Chairman Powell needs to see worse labor numbers or substantially lower inflation numbers before he cuts interest rates. And remember that there is a “surprisingly” strong June quarter GDP number coming on the morning of July 30 before the stock market opens.

Market Outlook

The S&P 500 added 2.7% since last Wednesday and hit a new all-time high today for the firsr time since February. The Index is up 4.4% year-to-date. The Nasdaq Composite gained 3.2% to a new all-time high today and is also up 4.4% for the year. The SPDR S&P Biotech Exchange-Traded Fund (XBI) climbed 1.2% since the last issue. But it is still down 7.1% year-to-date. The small-cap Russell 2000 gained 2.8% and is down 2.6% in 2025.

The fractal dimension again is hinting that the consolidation may be over, and a new, roughly three-month-long, uptrend could start with indexes near all-time highs. One big up week or two or three smaller up weeks would do it.

Below The Paywall This Week

* * we***have***a***winner!

* * including evaluation of strategies for accelerated approval.

* * a delisting notice from Nasdaq

Coming Events for Free Subscribers

All times below are EDT.

Monday, June 30

Business Employment Dynamics - 10:00am – More hard truths about real payroll growth before the election

Friday, July 4

Markets Closed

Happy 249th, America!

Biotech Moonshots Portfolio Update

This was a meh week for the portfolio because I misjudged Wall Street's reaction to some early Phase 3 results that I (1) expected, and (2) think will lead to drug approval. The Moonshots portfolio fell 0.9%, but there's enough clinical and other data coming to drive our performance much higher in 2025. Let's dig in...

* * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * *

Warren Buffett’s First Interview

* * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * *

“On June 11, 1776, the Continental Congress nominated a drafting committee of five men to compose a Declaration of Independence. The committee consisted of one southerner – Thomas Jefferson of Virginia – two New Englanders – John Adams of Massachusetts and Roger Sherman of Connecticut – and two from the Middle Colonies – Robert R. Livingston of New York and Benjamin Franklin of Pennsylvania. On July 1, 1776, Congress reconvened. The following day, the Lee Resolution for independence was adopted by 12 of 13 colonies, with New York not voting. Immediately afterward, the Congress began deliberating the Declaration. With minor changes by Adams and Franklin, Congressional discussions produced some alterations and deletions. But the basic document remained Jefferson's. The process of revision continued through all of July 3rd and into the late morning of July 4th, when the Declaration was officially adopted.”

h/t @DiMartinoBooth

* * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * *

Your Why Everything Feels Like It's Breaking—and Why That's the Point Editor,

Paid subscriber or not, if you would click the ♥ symbol below, it would really help me get the word out.