Dear Biotechies:

The SPDR S&P Biotech Exchange-Traded Fund (XBI) fell 8.4% since last Thursday, even after a 7.3% spike on Wednesday. It hit a 52-week low Wednesday morning and is down 20.5% year-to-date.

The index's percentage deviation from its 200-day moving average for this leg of its post-2021 bear market has cycled back to the -25% to -30% area, matching the lows during the Great Financial Crisis (-28%), the February 2016 low (-38%), the December 2018 low (-36%), and the Covid low (-35%). Deeper readings greater than -40% have occurred only three times (April 2001, July 2002, and May 2022), when the biotech sector swung from a disorderly blow-off top to a meltdown bottom.

h/t @EdenRahim

At the top of each issue, I write: The biotech bear market since February 2021 has created some dramatically underpriced stocks. There is free money lying on the sidewalk, just waiting for you to pick it up.

What do I mean by “free money?” Just that the two most important industries for the future of the US and the world are Artificial Intelligence and Biotechnology. They will reshape our lives over the next two decades. AI stocks had a huge run and have corrected – I recommend several of them in my New World Investor and Boomberg newsletters. But while AI was being recognized for the transformative technology it is, biotech – equally or even more transformative – was trashed. It was like the Islamic law that saying “I divorce you” three times is an irrevocable divorce, except Wall Street said: “I divorce you, I divorce you, I divorce you, and I throw doggy poopy on your shoes.”

The result is free money as biotech remakes health care and numerous small- and mid-cap biotechs create blockbuster drugs to cure previously untreatable diseases and extend healthspans and lifespans.

The Biotech Moonshots portfolio currently includes 10 positions. One, TG Therapeutics (TGTX), has given us a 250% return and is a Hold for an acquisition bid. The other nine Buys are free money:

1. $2 stock, $700 million market cap, over $650 million in cash, below book value, numerous Big Pharma partners, dominates its technology

2. <$2 stock, $450 million market cap, approved drug growing rapidly, $100 million in cash is enough for two years

3. $15 stock, $1.5 billion market cap, over $1 billion in cash, unique technology, in very successful Phase 1/2 trial, target price $150 or more

4. $3 stock, <$300 million market cap, $300 million in cash, in registrational Phase 3 trials, data coming midyear, will get first FDA psychedelic approval

5. $1.50 stock, $100 million market cap, >$250 million in cash, genomics IP leader

6. <$2 stock, $60 million market cap, $90 million in cash, FDA approval coming in 2026, deep pipeline, target price $100 or more

7. <$8 stock, $800 million market cap, $800 million in cash, next gene therapy approval 2026

8. 65¢ stock! $20 target! $50 million market cap, $39 million in cash with low burn rate, blockbuster drug in development, Big Pharma partner

9. 90¢ stock! $20 then $50 target! $34 million market cap, $75 million in cash. Approved drug, Big Pharma partner. Good news is coming any day.

TL:DR BIOTECH IS STUPID CHEAP.

* * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * *

It's been a week of Tariff Tantrums and Inflation Fears. Thursday's Consumer Price Index report for March showed less inflationary pressures. The headline index was up 2.4% year-over-year (YoY), its lowest increase in four years, a tenth under the 2.5% consensus and better than February's 2.8%. Month-over-month (MoM), it fell 0.1%, the first MoM drop since May 2020. That was below the consensus estimate for a 0.1% increase and below February's 0.2%.

h/t Yahoo Finance

The more important (to the Fed, anyway) core index was up 2.8% YoY, also the lowest increase in four years, well below the 3.0% consensus and February's 3.1%. Month-over-month (MoM), it increased 0.1%, below the 0.3% consensus and under February's 0.2%. The lagging and therefore misleading core shelter index was up 4.0% YoY, its smallest increase since November 2021. It will continue to fall.

I still don't think that's enough to push the Fed to lower rates at the May 7 meeting, especially with tariff uncertainty. The June 18 meeting is still my best guess, unless the June quarter GDPNow forecast picks up substantially. The Fed doesn't know how or even if tariffs will affect the economy or inflation measures, and the labor market doesn't seem to be falling apart.

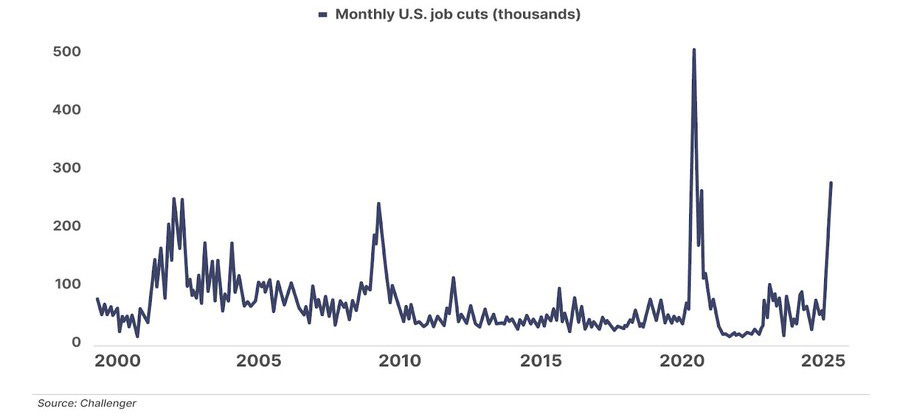

As I wrote last week, the payrolls report showed 228,000 new jobs were created in March, way more than the 140,000 expected by economists. On the other hand, the Challenger Job Cuts report showed that US companies cut 257,240 jobs in March, the biggest jump in layoffs since the pandemic.

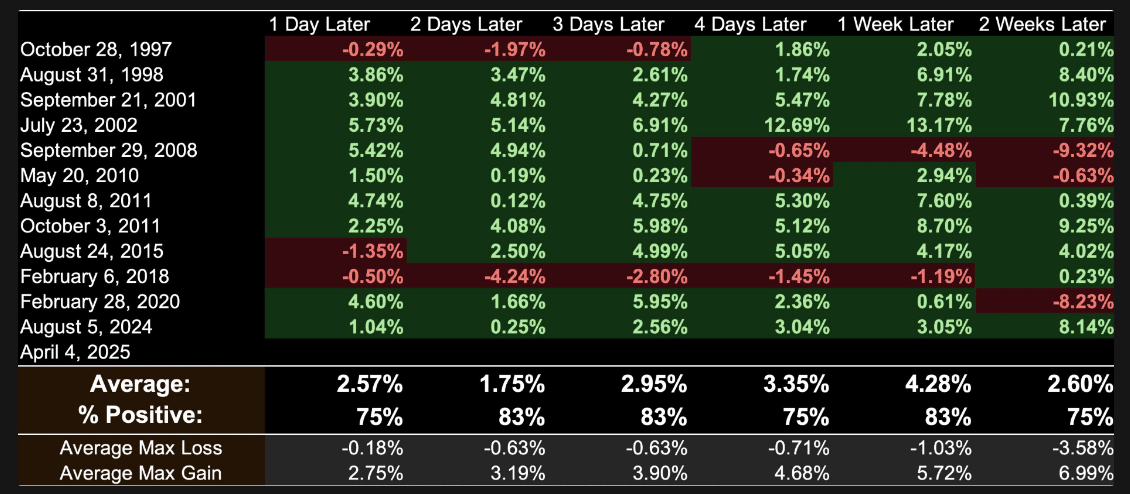

In the Tariff Tantrum, the VIX Fear & Greed Index went over 45 last Friday and reached 57.96 on Wednesday morning. When the VIX has closed above 45 in the past, here's what the S&P 500 did over the next few days:

h/t @TheMarketEar and @SubuTrade

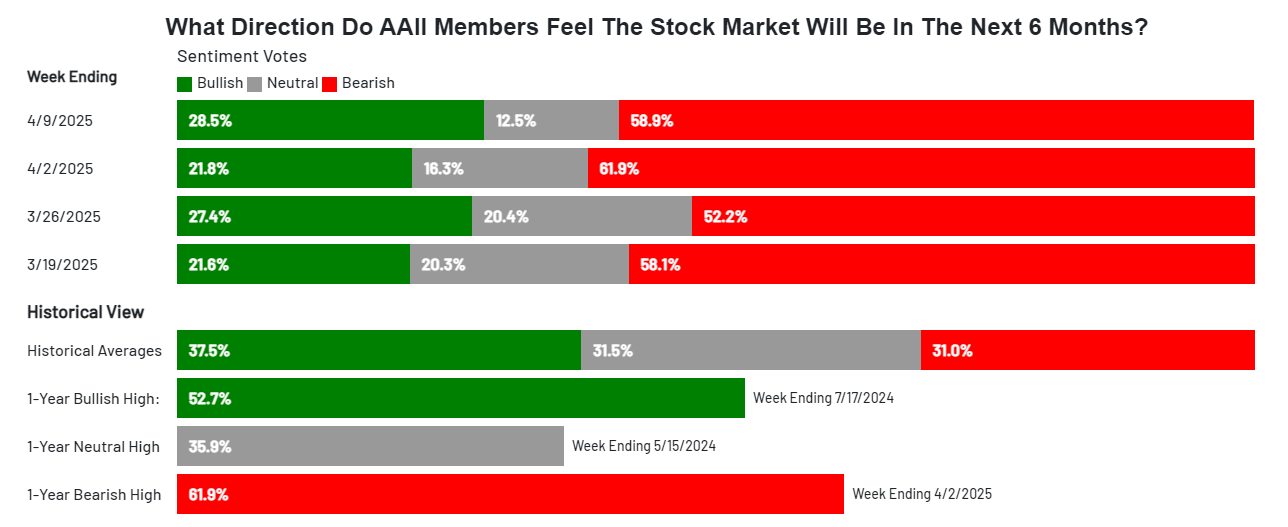

At the lows this week, retail investors were in panic mode, also known on Wall Street as an opportunity to pick some low-hanging fruit. They are still feeling extreme fear.

h/t @CNN

Investors Intelligence sentiment of investment newsletter writers collapsed to 23.6%, the lowest level since December 2008.

h/t @SubuTrade

And the American Association of Individual Investors survey remains overwhelmingly bearish.

h/t AAII

With about $7 trillion on the sidelines, there's plenty of room for bears to turn positive and buy stocks.

Market Outlook

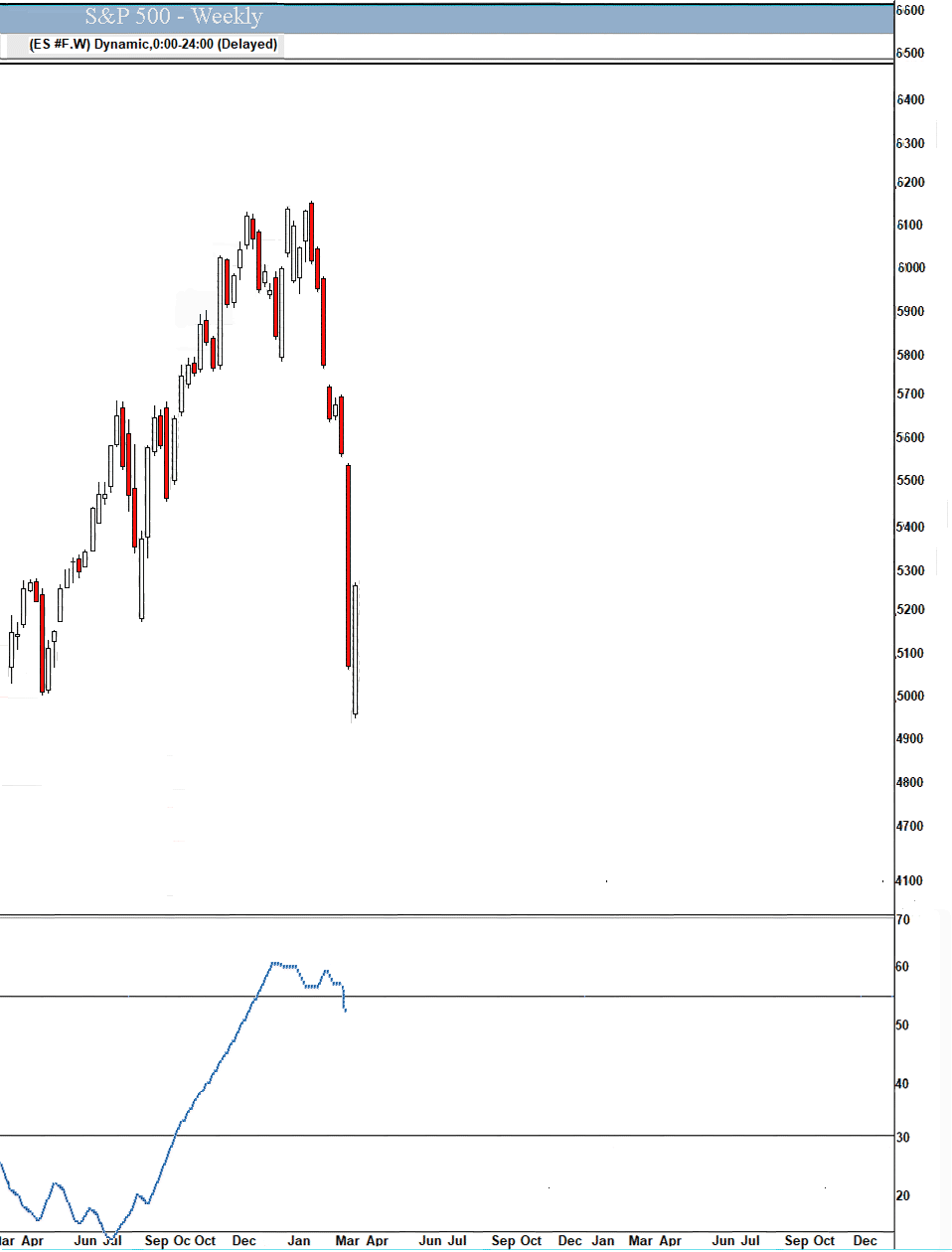

The S&P 500 lost 2.4% since last Thursday, which was the worst day for US stocks since June 2020, down 4.8%. Friday was even worse, with the S&P 500 down 6.0%. The Index fell 11% Thursday/Friday - the fifth-biggest two-day decline since 1950. The only worse two-day declines were Black Monday in 1987, the Great Financial Crisis in 2008, and the COVID lockdown crash of 2020. Check out the market’s returns one, three, and five years after each two-day crash. Stocks went substantially higher 100% of the time.

h/t @charliebilello and @Hedge_Your_Risk

After a 9.5% rally Wednesday – the third best day since 1990 – and Thursday's 3.5% drop, the Index is down 10.4% year-to-date. The Nasdaq Composite lost 1.0% since last Thursday, mostly recovering from a 5.8% drop last Friday, and is down 15.1% for the year. The SPDR S&P Biotech Exchange-Traded Fund (XBI) fell 8.4%, even after a 7.3% spike on Wednesday. It hit a 52-week low Wednesday morning and is down 20.5% year-to-date. The small-cap Russell 2000 dropped 4.1% and is down 17.9% in 2025.

Last Friday's wipeout doubled the length of the red weekly candle, but so far this is an up week. Even so, the fractal dimension fell a little and still indicates a real downtrend is underway. This can last anywhere from a couple of weeks to a couple of months, depending on whether we rebuild the energy by more sharp price drops or just by boring churning for a while.

Economy

The Atlanta Fed's GDPNow model still forecasts a negative real GDP number for the March quarter, although slightly less negative at -2.4%. The alternative model forecast, which adjusts for imports and exports of gold as described HERE, is at -0.3%. The Blue Chip economists are finally getting the memo.

To show you how panicked Wall Street is, at 12:57pm on Wednesday, Goldman Sachs called a US recession. 73 minutes later, they rescinded it.

h/t Zero Hedge

Below The Paywall This Week

* * a significant unmet need for more effective therapies that can treat the entire spectrum of disease manifestations

* * the fifth competitive program just failed, and some of the failures were from multi-billion-dollar acquisitions

* * will do a registration-directed trial to combine the currently approved Day 1 and Day 15 doses into a single 600 milligram dose on Day 1

Coming Events for Free Subscribers

All times below are EDT.

Tuesday, April 15

Tax Day!

Friday, April 18

Markets Closed - Good Friday

Biotech Moonshots Portfolio Update

It may surprise you to hear that in spite of another rough week for biotech, the portfolio slipped only 0.6%. There's enough clinical and other data coming to drive our performance much higher in 2025. Let's dig in...

* * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * *

The Secular Bull Market Isn't Dead: Jim Paulsen on Why Tariffs Won't Break It

* * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * *

Shadow & Jackie Raising Two Eaglets

* * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * *

Your Rational Optimist Editor,

Paid subscriber or not, if you would click the ♥ symbol below it would really help me get the word out.