The biotech bear market from February 2021 through October 2023 created some dramatically underpriced stocks. There is free money lying on the sidewalk, just waiting for you to pick it up.

Dear Biotechies:

@EdenRahim is a must-follow biotech portfolio manager who keeps close track of the breadth statistics in biotech – what percentage of biotechs are trading above or below various moving averages and such. He recently posted: “ Besieged biotech seemingly invents new measures of futility. Over a 1/3rd of Top 250 Bios are within 5% of a 1-Yr low. And this excludes the apocalyptic walking dead among the shelled 500 microcaps. And we're only in Q1. After 4 years of this, this is the norm, not the exception.”

h/t @EdenRahim

Biotech certainly has seen some very bad days. On October 12, 2023, he posted: “How dismal a liquidation day was it in biotech? For $XBI, decliners pounded advancers 20:1 (124/6) & 12:1 (234/20) for IBB. Pct of bios > 50-d plunged from 24% to < 12% today, gunning for May 2022 30-year low of 6%. Only 1 new high & 46 new lows, with 75 within 5% of New Lows.”

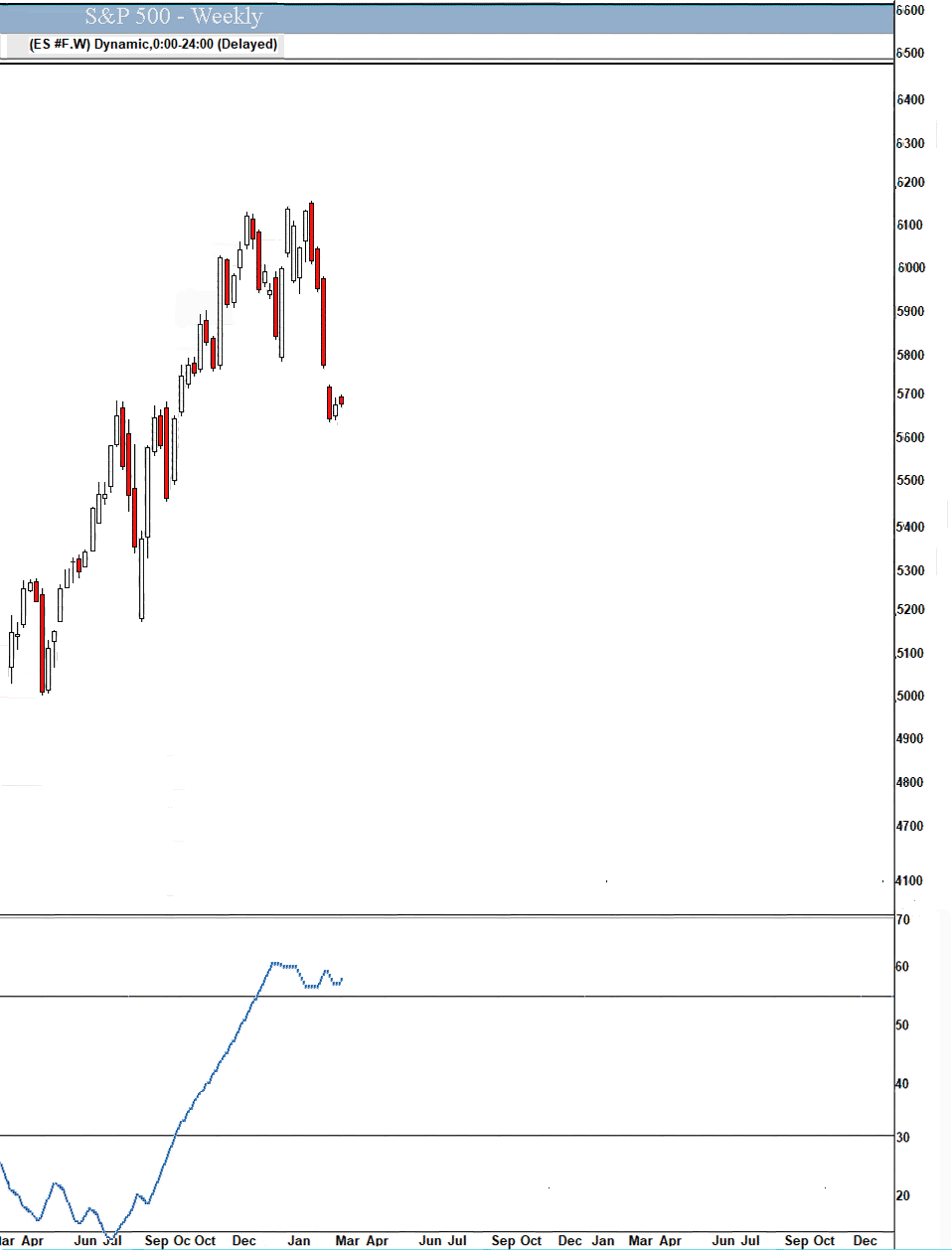

Looking at the green line in the chart above, I think it is reasonable to say that when around 38% of the top 250 biotech stocks get within 5% of their 52-week low, rallies start. The iShares Biotechnology Exchange-Traded Fund (IBB) is at 130 instead of the ~110 or so we saw in May/June 2022 and October 2023. Those waiting for 110 may be the smart ones, but I think the 38% trumps 110.

Biotech Moonshots is about finding the hidden jewels in the “shelled 500 microcaps” and doing something the pros can't do – holding on through the bad times until Mr. Market says: “Hey, wait, that's actually a jewel over there.”

The pros can't do that because they will, in ascending order of terrible, underperform, get a reduced bonus, lose clients, and get fired. Patience is the retail investors’ Superpower if you have really found a jewel. We have 8 of them in our 9-stock portfolio. The ninth one is up 293% already and I'm waiting for a buyout bid.

* * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * *

Today's panic was brought to you by the Personal Consumption Expenditures Index for February. The headline PCE increased 2.5% year-over-year, the same as January, and 0.3% month-over-month, right on the consensus expectations. The Fed's favorite inflation indicator, the core PCE that excludes food and energy, rose 2.8% year-over-year, a tenth above January's revised 2.7% and expectations for 2.7%. The month-over-month increase of 0.4% was also a tenth above January's 0.3% and expectations for 0.3%.

So does a tenth justify an S&P 500 drop of 1.97%? No, because inflation is collapsing. @DiMartinoBooth wrote: “Per Truflation, on a time continuum, their metric tells you with near-perfect accuracy where the CPI will be 45 days hence. There was thus no irony in TJM Institutional Services’ Mark Gomez sharing first thing this morning that Truflation had printed at 1.32%, down from 2.70% when Federal Reserve policymakers last convened on January 31.”

Does that mean the economy is slowing? Yes. Into a recession? Too early to tell, but a short, shallow recession would make a lot of sense, even though the third estimate of December quarter real Gross Domestic Product growth was raised a bit to +2.4% thanks to a year-end surge in consumer spending. That still was below the September quarter's +3.1%. It brought the full 2024 year in at +2.8%, virtually the same as 2023's 2.9%.

The Atlanta Fed's GDPNow model forecast for March quarter real GDP projects a 1.8% decline. Adjusted for imports of gold, which can be treated as a one-time effect, it shows a measly 0.2% advance. The Blue Chip economists are starting to cut their forecast but still average +1.6%. We'll see the first estimate on April 30, and it sure looks like it will be low. The government employment and spending that DOGE is targeting supported growth in 2023 and 2024, and that is going away.

Market Outlook

Before today's drop, the S&P 500 added 0.5% since last Thursday as tariff fears and hopes alternated. The Index still is down 3.2% year-to-date. The Nasdaq Composite edged up 0.6% but is down 7.8% for the year. The SPDR S&P Biotech Exchange-Traded Fund (XBI) fell 1.2% even though biotech is not affected by the tariffs. It is down 5.0% year-to-date. The small-cap Russell 2000 was virtually unchanged, dropping 0.1%, and is down 7.4% in 2025.

The fractal dimension still isn't showing a new trend as it continues to consolidate the big Trump rally. It won't take much of an upmove to set off the next leg of this bull market.

Below The Paywall This Week

* * short-term traders sell the bounce and long-term investors use the weakness to complete their positions

* * a milestone they will announce in the coming weeks

* * It's nice to have a deep bench when you are a small company

* * the FDA granted Regenerative Medicine Advanced Therapy (RMAT) designation

Coming Events for Free Subscribers

All times below are EDT.

Friday, April 4

March payrolls - 8:30am

Biotech Moonshots Portfolio Update

This was a nowhere-to-hide week for biotech. The Moonshots portfolio fell 7.3%, but there's enough clinical and other data coming to drive our performance much higher in 2025. Let's dig in...

* * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * *

* * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * * *

Your Always Tell Me The Odds Editor,

Paid subscriber or not, if you would click the ♥ symbol below it would really help me get the word out.